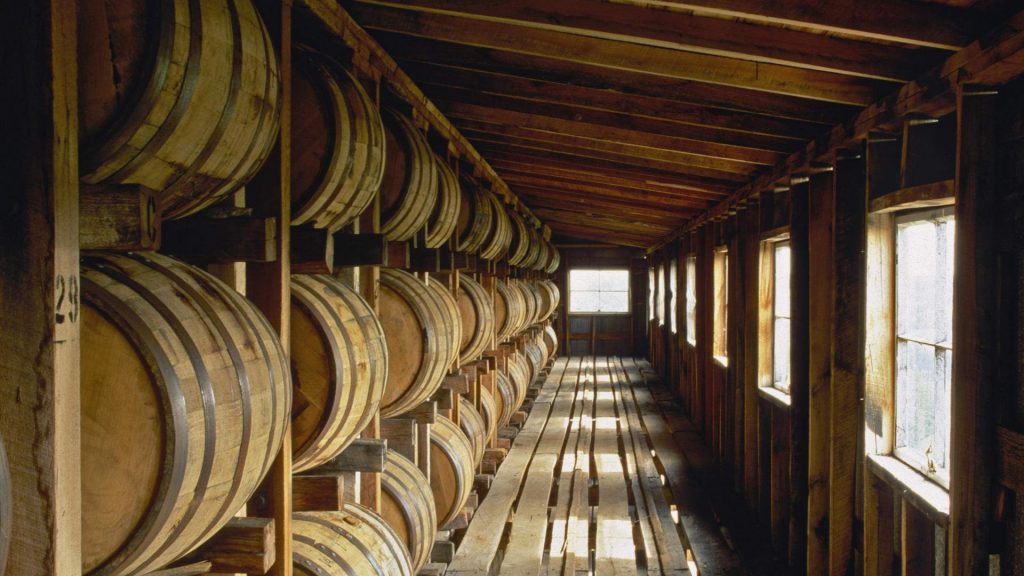

Das stetige Wachstum der Bourbon-Industrie in Kentucky findet jetzt Ausdruck in einer imposanten Zahl: Es lagern nun bereits über 10 Millionen Fässer Bourbon in den Warehouses der Erzeuger in Kentucky.

Zu den 10.321.793 Fässern, die zum Erhebungszeitpunkt in den Lagerhäusern zu finden waren, kommen noch 558.535 Fässer mit anderen Spirituosen wie zum Beispiel Brandy hinzu, und mittlerweile, da Sie diese Zeilen lesen, werden es dann insgesamt wohl schon 11 Millionen Fässer sein.

Der Zuwachs im letzten Jahr kann sich ebenfalls sehen lassen: 2.5 Millionen Fässer sind alleine 2020 produziert worden, und damit wurde der Rekord von 2019 erneut gebrochen.

Hier die Pressemitteilung der Kentucky Distillers Association (KDA), die darin auch eine Verringerung der Steuerlast für ihre Mitglieder einfordert:

THE PROOF IS HERE®: MORE THAN 10 MILLION BARRELS OF BOURBON AGING IN KENTUCKY DISTILLERY WAREHOUSES

Bourbon Industry Calls on General Assembly to Stop Punitive Production Taxes

RANKFORT, Ky. – For the first time in the modern era of American whiskey, Kentucky has 10 million barrels of Bourbon aging in distillery warehouses across the Commonwealth, the Kentucky Distillers’ Association announced today.

Kentucky’s legendary distilling industry also set new production records for the number of Bourbon barrels filled in a single year – nearly 2.5 million – and for the total number of all aging barrels including other spirits such as brandy, at nearly 11 million. These numbers are for calendar year 2020.

“Kentucky’s signature Bourbon industry continues to invest in our Commonwealth at unprecedented levels, despite global pandemic disruptions, exorbitant taxes and ongoing trade wars. This is truly a historic and landmark record.”

Eric Gregory, President of the Kentucky Distillers’ Association

But that milestone comes with a cost, Gregory said.

Distillers will pay a record $33 million in aging barrel taxes in 2021. Kentucky remains the only place in the world that taxes aging barrels of spirits as part of the production process, a discriminatory tax that hampers growth and jeopardizes the state’s ability to attract new distillers.

Barrel taxes have catapulted 140% in the last 10 years alone, Gregory said.

“The Bourbon industry is investing more than $5 billion in this state to increase production, build innovative tourism centers and create thousands of new jobs,” he said. “But punitive barrel taxes are punishing this growth and harming our chances to land new distilleries.

“It’s time for the legislature to take action and make barrel taxes refundable or transferable, which will further incentivize distilling investment in the Commonwealth. Kentucky should not have a tax structure that penalizes growth and investment on any manufacturer.”

Even though the Kentucky legislature passed a corporate income tax credit in 2014 to offset barrel taxes, the escalating number of barrels – and therefore taxes – far outpaces the amount of credit that distillers can take, Gregory said. Some distillers now only realize 30% of the credit.

The new production numbers are based on inventories reported as of Jan. 1, 2021, submitted to the Kentucky Department of Revenue for tax purposes and includes all distilling companies in Kentucky, the vast majority of which are KDA member distilleries.

Here are the specifics:

- Total barrels of Bourbon: 10,321,793

- Total inventory including Bourbon and other spirits: 10,880,328

- Number of Bourbon barrels filled in 2020: 2,437,603

The previous records for all three categories were set in calendar year 2019 and reported on Jan. 1, 2020.

The Kentucky Bourbon revolution has seen tremendous growth since the turn of the century. Production has skyrocketed 436% since 1999. The state’s aging Bourbon inventory has increased 200% during that time while the total number of all barrels has nearly tripled.

The tax-assessed value of all aging barrels is now $4.4 billion, the first time it has surpassed the $4 billion mark and a staggering $589 million increase over the previous year.

Distilling remains the highest taxed industry in the state, paying more than $300 million every year in state and local taxes. Meanwhile, an upcoming economic impact study will show that Kentucky leads the nation in federal excise taxes on alcohol, paying $1.8 billion each year with almost all coming from distillers.

This means that Kentucky distillers pay about $2 billion each and every year to the government in taxes.

Bourbon is one of the Commonwealth’s most historic and treasured industries, an $8.6 billion economic engine that generates more than 20,100 jobs with an annual payroll topping $1 billion. Distillers also are in the middle of a $5.1 billion capital investment campaign to satisfy the global thirst for Kentucky Bourbon.

Unfortunately, retaliatory tariffs and never-ending trade wars continue to pose serious threats to those global exports, Gregory said. The European Union imposed a 25% tariff on American whiskey and other goods in 2018 in response to a U.S. tariff on steel and aluminum from the E.U.

As a result, Kentucky Bourbon exports to the E.U. and the United Kingdom – the state’s largest whiskey export market – have plunged nearly 50%, according to data from the state Cabinet for Economic Development.

And it could get worse – the E.U. tariff on American whiskey is set to double to 50% on Dec. 1.

The KDA recently joined a coalition of 50 trade associations representing the entire three-tier chain of the U.S. alcohol industry in a letter to Secretary of Commerce Gina Raimondo and Trade Ambassador Katherine Tai urging the Biden administration to secure the suspension of tariffs on American whiskey.

“Our industry is collateral damage in trade disputes that have nothing to do with Bourbon,” Gregory said.

“We reiterate our request that the Biden administration secure the immediate suspension of tariffs on American whiskey before more long-term damage is done. It’s been more than three years. The time to act is now.”